Five financial mistakes doctors make and how to avoid them

Partner Content Nov 23, 2018

Doctors have very little time to attend to their own financial well-being in terms of their personal finances. Most doctors, therefore, turn to easy investment options that do not require them to understand too much. Or, they rely on information and tips which leads them astray. Here are 5 common mistakes doctors make in personal finance.

Mistake #1. Investing in tax inefficient products like FDs

We all know about FDs or fixed deposits. They are easily understood products and they give a guaranteed rate of return. The problem with fixed deposits, whether issued by banks or corporates, is that they are tax-unfriendly.

Interest from fixed deposits is added to your normal income and you are taxed at the marginal rate of your tax bracket. Fixed deposits also lock in your money for specific periods of time and if you want premature redemption, there is a penalty to be paid which is taken from your invested amount.

The returns on FDs do not give scope for much capital appreciation especially during times when interest rates are heading down. Doctors make the mistake of investing in FDs because it is a product that is easy to invest in with minimum hassles.

Solution: Invest in debt mutual funds or fixed maturity plans of mutual funds.

Mistake #2. No diversification of assets

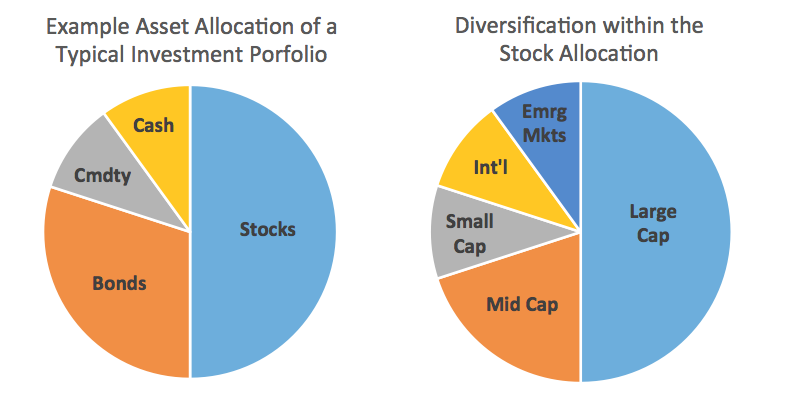

If most of the investments are either in one product or in one asset class, the portfolio can become exposed to considerable risk if the investment fails or does not perform according to expectations.

For example, if you invested all your savings in the fixed deposit of Company X, and the company defaults, you will face the prospect of not getting back your investments or it could take a long time to get it back.

Solution: Invest in both debt and equity instruments. Within those asset classes, you can diversify further.

Mistake #3. Handling their own money

Doctors make the mistake of handling their own money, despite not having the expertise to do so. They do not take the help of financial advisors who will give them the required help. It is a bit like performing surgery on yourself.

We know what happens when we self-medicate or try to diagnose our illness with half-baked knowledge garnered from friends, relatives and even worse, from the Internet. There is every chance of going wrong and doing harm to our bodies and health.

It is the same with money and doctors are even more handicapped simply because of the paucity of time and the fact that they are occupied with other things most of the time. This leads them to make inefficient investment choices or investing in products that yield very little returns.

Taking advice from a financial planner or investment adviser will minimise their chances of going wrong with the management of their money. In fact, Robo advisory platforms such as Invezta provide a do-it-yourself facility for transacting at minimum cost, keeping track of investment portfolios and giving advice that is easily understood.

Since there are no distributors fees involved, the recommendations are product-agnostic and based on individual goals and performance of the schemes.

Solution: Engage a robo advisor or financial planner to look after your personal finance needs.

Mistakes #4. Falling victim to bank salespersons

Doctors, especially specialists, attract bank sales representatives who see in the high incomes that many doctors earn, an easy way to meet their targets for product sales. Many of them also become innocent victims of relationship managers of banks who sell them products that have high commissions or expensive insurance policies.

Mutual funds are sold to them, not on the basis of their financial goals, but based on schemes, which carry high commission rates.

Solution: Make financial goals and ensure that what you invest fits in with those goals.

Mistake #5: Thinking about retirement

There is no specific retirement age for doctors and they can have a thriving practice as long as they want and their health permits. However, this does not mean that they should not think about retirement or plan for it.

Many doctors, attached to hospitals, often dream about having their own practice where they can do work or some of them even plan to write papers and get into research or teaching with a view to helping the next generation. If that is the aim then they need to think about creating a corpus for the years when they may not be actively practicing.

Solution: Think long-term when investing so that you have a good corpus by the age of 60 or 65.

Disclaimer- The views and opinions expressed in this article are those of the author's and do not necessarily reflect the official policy or position of M3 India.

-

Exclusive Write-ups & Webinars by KOLs

-

Daily Quiz by specialty

-

Paid Market Research Surveys

-

Case discussions, News & Journals' summaries