Make more money by investing in direct mutual funds

M3 India Newsdesk Feb 07, 2019

When investing in mutual funds, it is always better to choose direct plans rather than go through middlemen. This results in additional returns of anything between 0.5 to 1% annually, compared to investments in regular plans.

When a hospital buys different types of equipment and medical supplies, it usually has to go to a local dealer or supplier to make these purchases. Now how about if you went directly to the original equipment manufacturer (OEM) to get the supplies?

For instance, could you purchase gloves directly from a company like Top Gloves or medical supplies directly from Cipla. It wouldn’t be possible to do this. But, in the case of mutual funds, you can directly buy (or invest) in schemes without going through middlemen.

Middle-men, brokers, agents or the more euphemistic intermediaries and distributors, however they are called, are the go-betweens in a transaction who take away a large chunk of the money as the product makes its way from the producer to the user.

Some of them are mandated by regulations - you can’t buy securities without brokers – in some cases they form a vital conduit whereby producers can sell their goods to customers, but there are products and services which would be all the better if there were no intermediation between those who make them and those who use them. Commissions and brokerages charged by the intermediaries inflate the price of the products and services for consumers.

Millennials or Generation Y people probably would not remember this but there was a time when the Public Provident Fund actually used to be sold through agents who got commissions for it. Investors need to realise that when there is a choice, it is better to buy a product directly from the manufacturer because that reduces your expenses and increases returns.

In 2013, in a bid to reduce the cost of investing in mutual funds, the Securities and Exchange Board of India directed mutual funds to offer customers the choice of investing directly in mutual fund schemes or going through a distributor. So now there are two distinct types of mutual fund schemes:

- Direct plans, where investors can invest directly in the schemes offered by fund houses

- Regular plans where the investor invests via an intermediary which can be a bank, a broker or an individual agent

What are direct mutual fund plans?

Mutual funds which are bought directly from the asset management companies (AMCs) are known as direct mutual funds. Intermediaries or brokers have no role in direct mutual funds. As result, the expense ratio of the mutual funds comes down. They have a different Net Asset Value (NAV), and the fund name will include “Direct” or “Dir” to help investors identify direct plans.

In order to make it even more convenient, you can make the purchases online directly from the websites like Invezta. Online purchases of direct plans of mutual fund schemes are also available with mutual funds' registrar and transfer agents such as CAMS and Karvy.

What are the advantages of investing in direct mutual funds?

From all the foregoing, you will have realised that investing directly in a mutual fund translates to lower costs for you.

What does that mean?

Every fund house has expenses in the form of asset management fees, administrative fees, broker commissions etc. and all of these expenses are taken out of the amount that you invest. A big chunk of it is due to broker commissions.

For instance, if the regular plan of a mutual fund scheme has an expense ratio (the total expenses as a percentage of its total assets) of 2.5 percent, the expense ratio of the direct plan would be less than 1 percent. Therefore your returns will be higher to that extent in terms of the lower costs that you are paying.

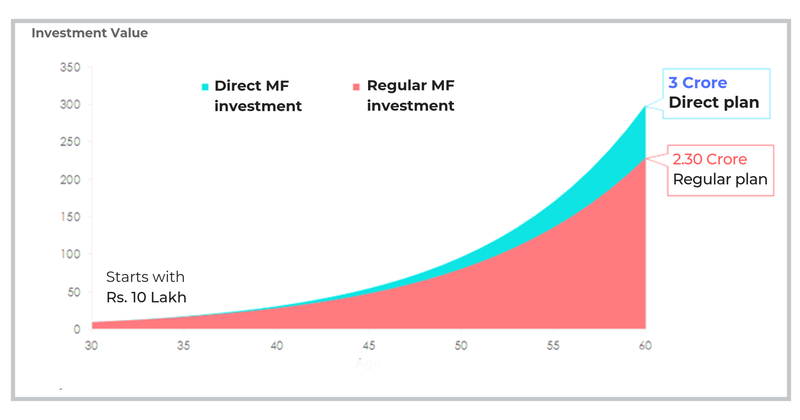

The following image shows the impact of commissions on a lump sum of INR 10 lakhs for a 30-year time frame. You will lose approximately INR 70 lakhs by investing in regular mutual funds.

Net asset values of direct plans are higher than the net asset values of regular plans, because of the lower cost associated with the latter. You can visit the website of any mutual fund and compare the mutual fund scheme NAVs of direct plans and the regular plans. You can easily spot the difference.

Invezta is a platform that allows investors to make investments in direct mutual fund plans and so avoid paying all the costly brokerage fees that make a dent on your returns. You get expert advice on the website at cost-effective rates so that puts you in control of your personal finance decision-making.

Without going into tedious calculations (more on that another time) let us state here that investing in direct plans results in additional returns of anything between 0.5 to 1 percent annually, compared to investments in regular plans. While that may seem like a small amount to you when you look at it in a year, when it is over a long period of time, say 10 and 20 years, it adds up to a substantial amount.

Disclaimer- The views and opinions expressed in this article are those of the author's and do not necessarily reflect the official policy or position of M3 India.

The article has been contributed by Invezta, a Robo advisory platform that provides a do-it-yourself facility for transacting at minimum cost, keeping track of investment portfolios and giving advice that is easily understood.

-

Exclusive Write-ups & Webinars by KOLs

-

Daily Quiz by specialty

-

Paid Market Research Surveys

-

Case discussions, News & Journals' summaries